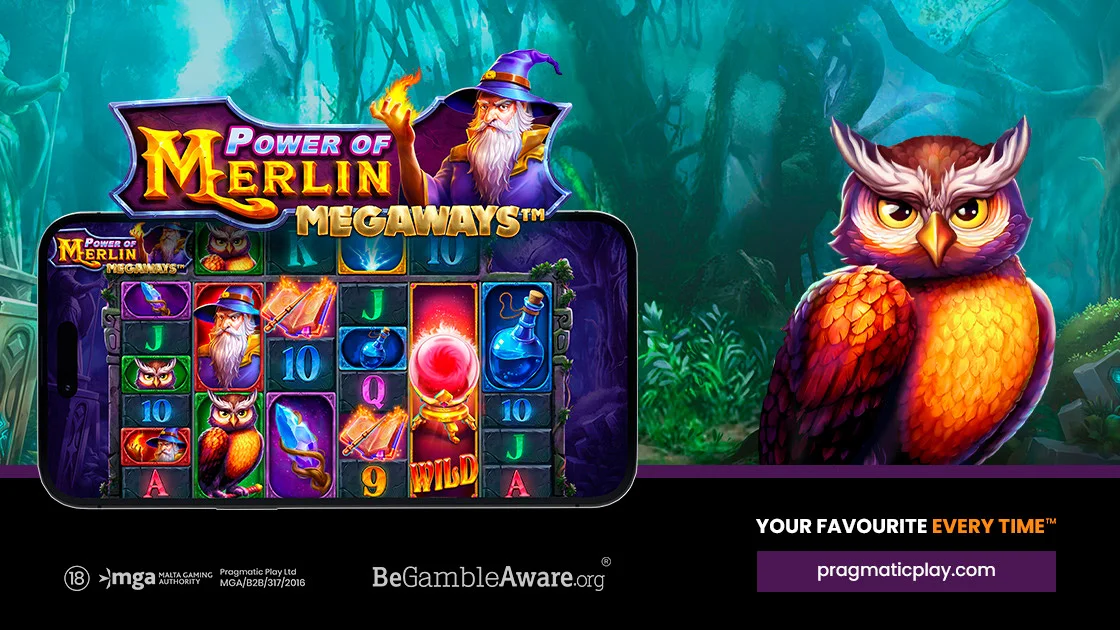

Power Of Merlin Megaways

Prepare to be enchanted by the mystical world of Power of Merlin Megaways, Pragmatic Play’s latest addition to their Megaways series. This slot game weaves a spellbinding narrative around the legendary wizard Merlin, offering players a chance to unlock the secrets of his magical realm. From the moment you load the game, you’re greeted by […]Prepare to be enchanted by the mystical world of Power of Merlin Megaways, Pragmatic Play’s latest addition to their Megaways series. This slot game weaves a spellbinding narrative around the